Everything You Know About Exposure to Risk is WRONG

How to expose ourselves to the right type of risk?

We need to start to see risk differently. Instead of seeing anything volatile as risky, why don't we start looking at it like "What stressors can I avoid and which must I face?".

Investors have studied risk extensively this past decade and one of them, Nassim Taleb, came up with the idea of Black Swans and how one should expose oneself to them.

He divided them into 2 possible exposures.

Concave, and Convex.

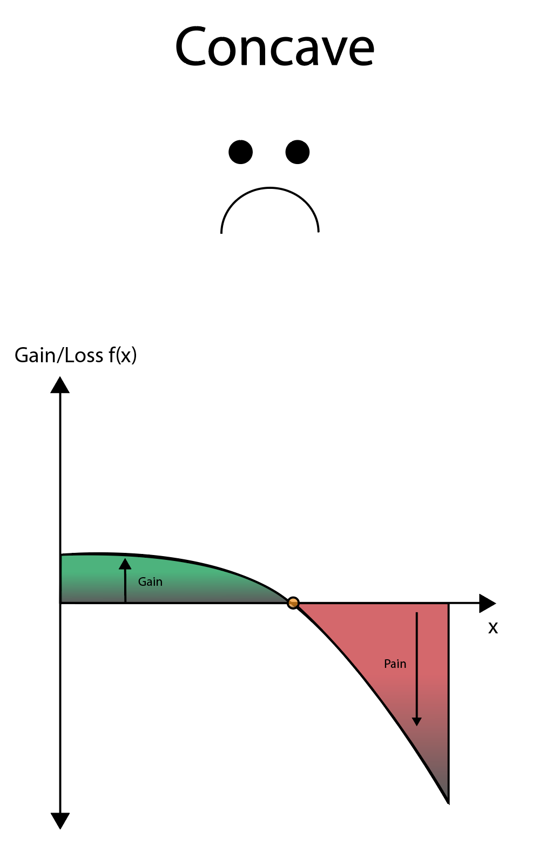

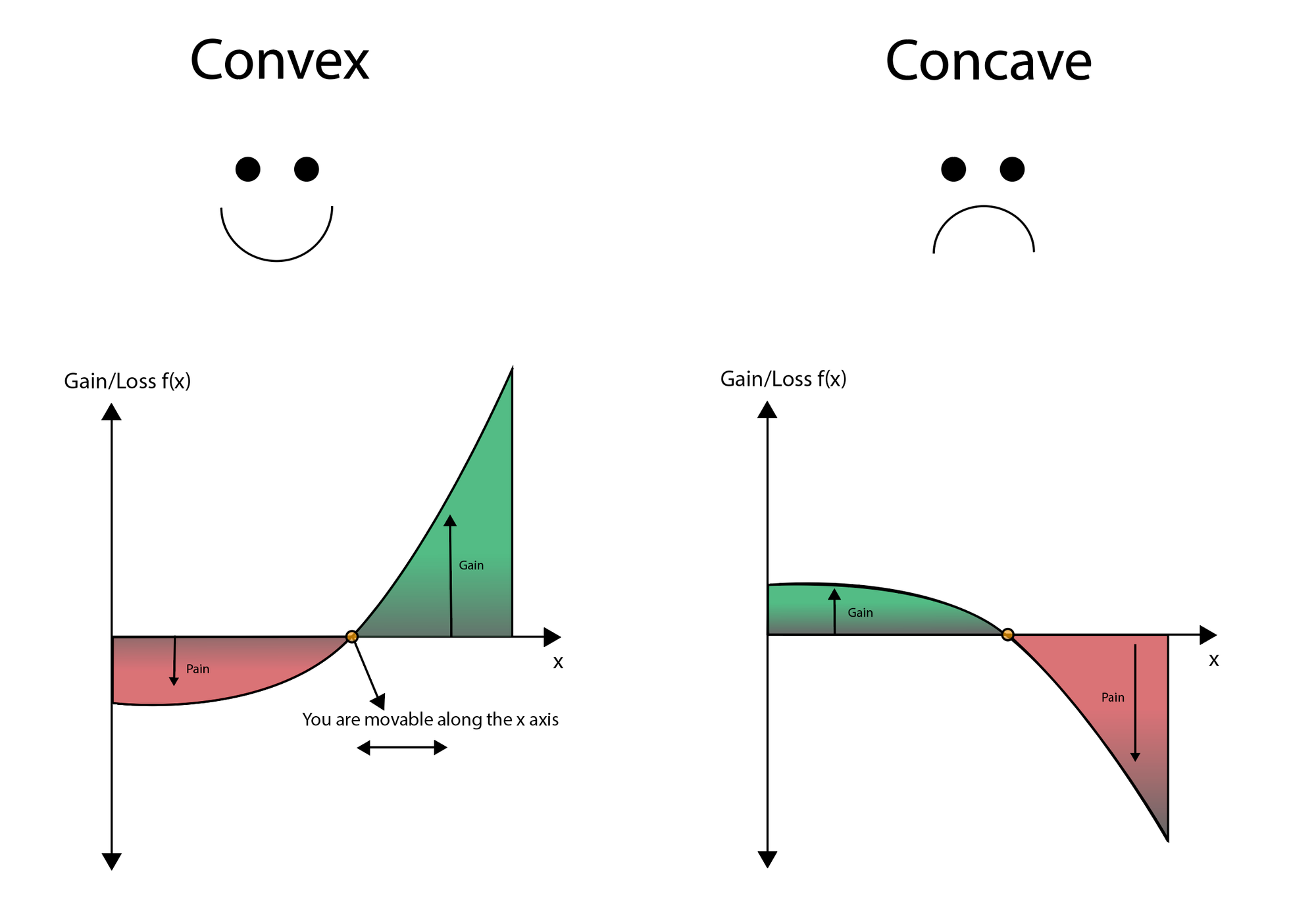

Concave

Basically, with Concave exposure, you have known gains and unknown possible losses.

- Where depending on the product you buy (leveraged future market) your losses approach infinity.

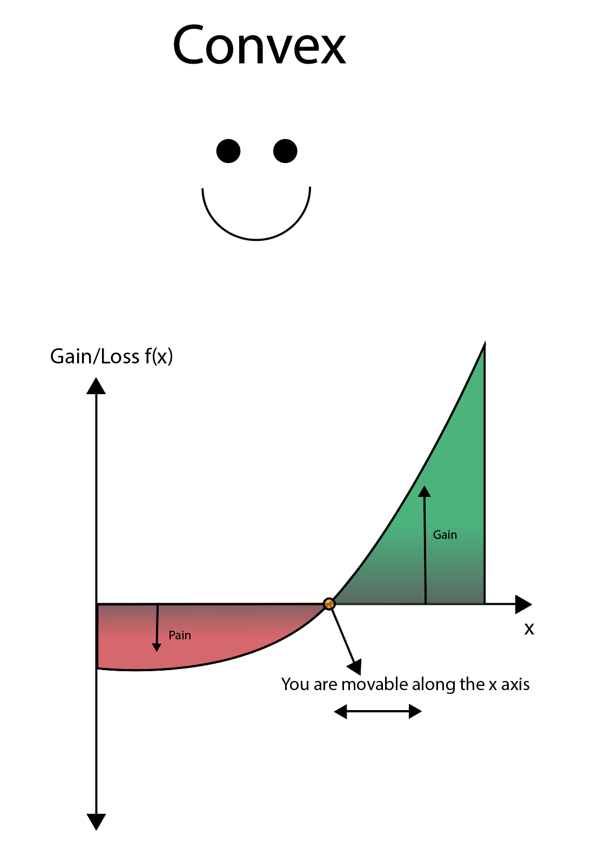

Convex

With Convex exposure, you have known losses (limited) and unknown possible gains.

- If you are exposing yourself in the financial market, you can be in a convex situation where the gains are virtually unlimited (startup investments), and the losses are known (the money you put in, no more than that).

Jensen's Inequality

Jensen's inequality is a mathematical concept regarding how for convex functions, the average expectation is greater than the expectation of averages. What does that mean?

Look at the picture again.

For convex payoffs, on average we will have a good result, even if individual observations give us consistent losses.

Example: Nassim has withstood significant daily losses for his shorts(betting against) the 2000s housing market. However, when he did win, he won big and it far exceeded his daily losses combined.

But for that to be the case, one needs to expose to stressors(the payoffs are the result of stressors).

And one needs to know which situation is convex(with limited damage and unlimited gains - like going to the gym) and when it's concave (limited gains - taking a pill for any pain - and possible unlimited losses - death from side effects).

😗 Enjoy my writing?

If you read more than 2 of my posts and loved them, we have a gentleman's agreement, which means you hit that subscribe button.

It's an agreement because I can't force you to do that, nor will I know if you don't, I trust you keep your end of the bargain and I will keep my end by continuing to publish weekly posts that bring value to you ;).

Feel free to Buy me a Coffee ☕.

Forward to a friend and let them know where they can subscribe (hint: it’s here).

Join an Exclusive Tech Friendly Community! Connect with like-minded people who are interested in tech, design, startups, and growing online — apply here.