Why Do Day Traders Quit after 5 Months 🥲?

How much are you willing to risk?

I'm going to present some thoughts I have on Day Trading compared with Value Investing.

For those who aren't aware of the terms a simplification would be:

- Day Traders: Trade during a full day, trying to get market trends that happen in a single day. Make decisions daily.

- Value Investors: Invest with a long period of time for analysis (months to years), normal to have decisions on a monthly basis.

Now that we are all on the same page, here's a journey of a regular Day Trader.

The Lifetime of a Trader

What I'm about to describe is the result of years of financial research compressed into simple words, if you want to take a look at the raw data feel free to check the resources below the post.

1st Month. They get a trading app, either Bloomberg's terminal, BlackArrow, or something alike. They play with the safety on (meaning with fake money). They read a lot of news and follow some reputable traders on social media, maybe even buy a course or two.

2nd Month. They decide it's time to get real, they turn the safety off and trade with their real money. If they're lucky, they get some nice little profits this first month, or they drop out sooner.

3rd Month. They get more excited due to the previous month's net positive and decide to buy more courses and start upgrading their daily bets. Unfortunately, they get a net negative this month, but hey, it's part of the game, isn't it?

4th Month. Now they want to recover their losses and start making riskier operations and start losing big time. If they hadn't a safety net before, this is the time the "game" gets too costly to be played on a long-term basis.

5th Month. They accept their losses and quit. Nothing more, nothing less. It's not a game for everyone.

Enters Value Investing

See the difference between Day trading to Value investing is one big thing: Expectations.

Value Investors tend to expect a much lower return on investment (ROI) for the same risk. Here's a simple heuristic to measure risk, if something returns more than 10% a year(or comparable to that year's S&P500) it either is riskier or it has more productivity than the top 500 companies in the US(Very unlikely), or both.

This heuristic allowed me to check for scam businesses and pyramid schemes. 1% a month is about 12% a year, riskier but not as risky as some pyramid schemes promising 1% a day(greater than 37000%)!

So if you know something is risky, it's better than not knowing it is risky at all, but there is an even better option: Knowing exactly WHY something is risky. That way you can have educated guesses and bet with more conviction on it.

So if something returns more than 10% a year it's risky, now you need to know what exactly that business is doing to grow that much. Maybe it has a new technology that allows it to grow from innovation and is capturing more chunks of the market, or maybe it's playing the numbers to get more investors.

This is how a value investor thinks, "what value is this company really bringing to the table that allows it to outperform the biggest companies out there?".

And because you are thinking about these sorts of problems you need to carefully look into a company's numbers and check how they changed from previous years. You also might need to take into account if the company is buying its own shares or just diluting them over the years. You might look into the current board of administration, if they got a good history building companies and if they are the best to handle the current market opportunities.

See how it's way too much stuff to take into account that you can't easily do it in a day? Most value investors take about 1 bet a month on a small-sized portfolio (if they don't decide to go with an ETF to have to think even less about it).

Who competes in the market against value investors? Well, most value investors buy when they calculate the valuation of the company to be higher than its stock price. That way they are buying the company at a "discount". Of course, every value investor will calculate the valuation their own way, so a bit of luck is involved.

In the end, a value investor competes with other value investors, in perfect conditions, they would never make any money out of each other, only with the growth of the company. That way, the one that manages to buy a company that does have a lower stock price than its "inherent value" tends to win over the long term.

Day Trading

Now things get a little bit interesting. Day traders are often looking at the graphs, trying to see patterns in the up and down movement of stocks. Most have more than one screen and work from the time the stock exchange opens till it closes.

Now everyone has a different way of identifying patterns and trying to one-up the market.

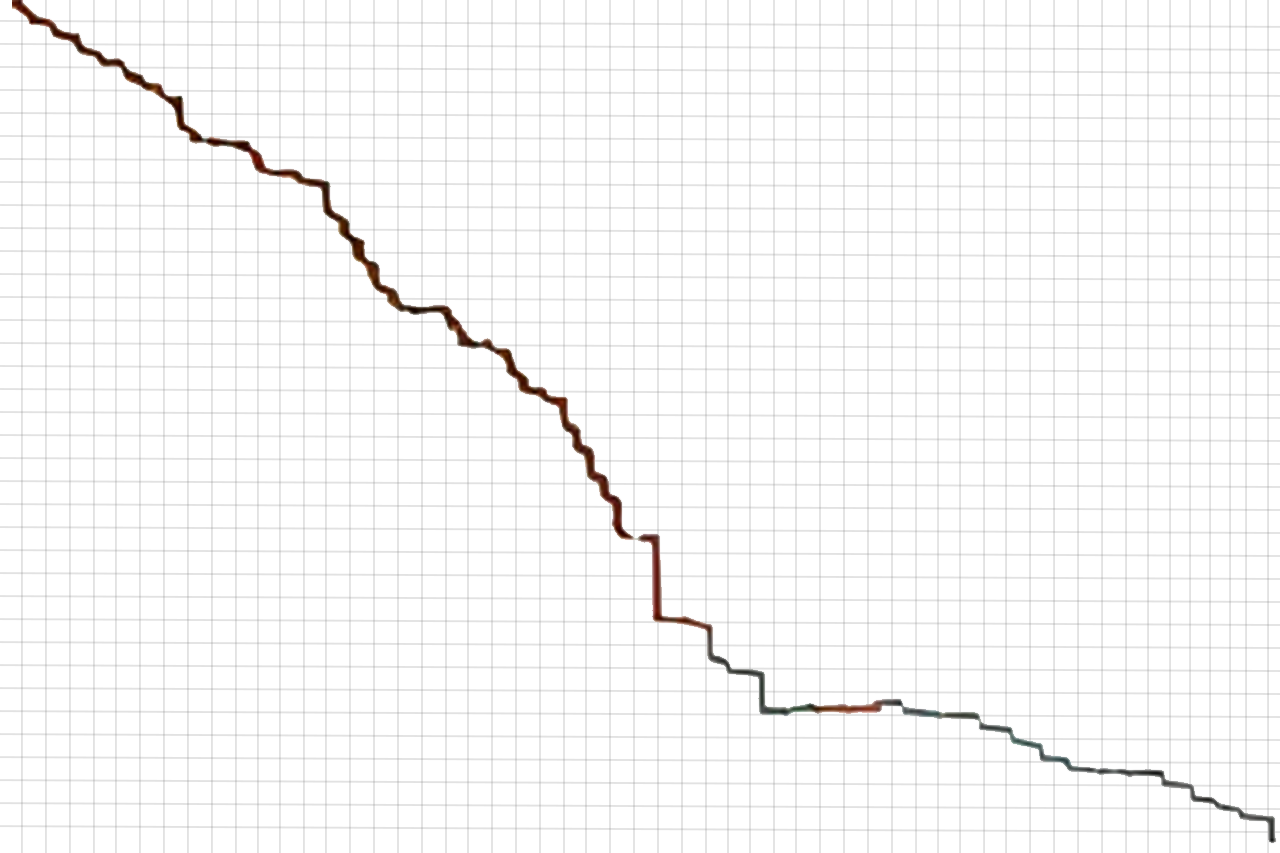

Let's see what you can extract from this graph from META's daily stock variation from last week:

Now a day trader would take into account different ways to analyze this data, particularly the candle information:

They would put some indicators on the graph, you can take a look at a bunch of indicators available for day traders in the example below:

So you see there are some indicators that I put below the candle graph:

Now here's where things get interesting, what if the patterns you think you are seeing in the morning while you just had some coffee and became glued to your Bloomberg terminal aren't really a real pattern?

Remember this picture below? I bet you thought "yeah META's stock is plunging a lot in a single day".

Look at it again, but now at the original image I pulled the graph from:

Your whole life is a lie, right? Yep day traders have to constantly battle market volatility AND not be "fooled by randomness" (Seeing patterns that aren't really real, like seeing faces on the surface of our moon, or Jesus on your toaster).

And who are day traders, with their fancy bots, trading apps with limitations on operations(to prevent you from making impulsive emotional decisions), and multiple screens competing against?

Who Competes with Day Traders?

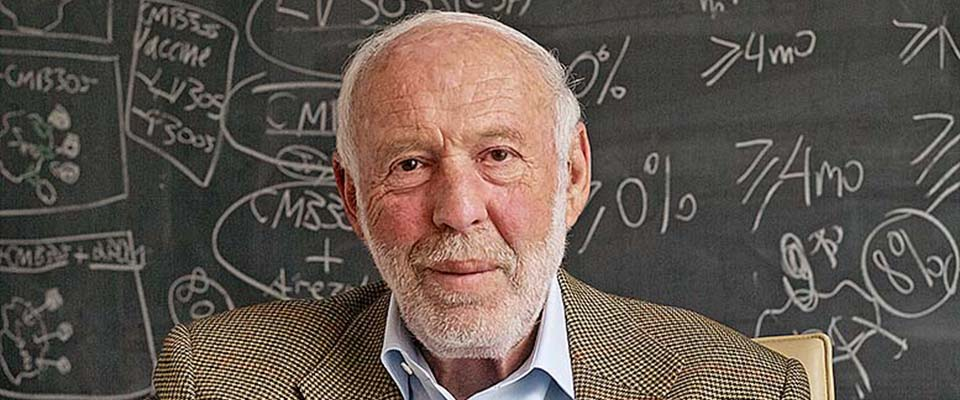

Enter James Simons, he's the "Billionaire Mathematician" founder of Renaissance Technologies and as I already said, both a billionaire and a mathematician.

I'm just going to share surface-level quotes that should already tell you where I'm going with this:

Renaissance uses computer-based models to predict price changes in financial instruments. These models are based on analyzing as much data as can be gathered, then looking for non-random movements to make predictions.

Medallion, the main fund which is closed to outside investors, has earned over $100 billion in trading profits since its inception in 1988. This translates to a 66.1% average gross annual return or a 39.1% average net annual return between 1988 – 2018.

Renaissance employs specialists with non-financial backgrounds, including mathematicians, physicists, signal processing experts and statisticians.

James Simons himself has run a study to know "who they're betting against".

Because most of their algorithms work in a single day trying to get an advantage over the market, and value investors rarely ever go with the flow in a single day, instead waiting until their beliefs about a company change, he got to the conclusion that it was the day traders.

Renaissance algorithms work on a day-to-day basis, running calculations on companies in nanoseconds (Compared with humans doing the same calculations in hours/days/months) and then acting based on it + other factors to make day trading possible and lucrative to them.

So I don't know about you, but I'd rather have a lower bar on competition, I'd rather compete with value investors than with James himself.

Which is more likely? To win several bets in a row where you bet in future growth for companies(with fewer volatility and risk), or beat a team of highly trained scientists, statisticians, and mathematicians, with machine learning algorithms connected to the stock exchange that run operations in nanoseconds (The time it takes for you to blink between your sip of coffee to look at your second Bloomberg terminal).

In summary, one can expect to get money from day trading, but is it a reasonable expectation? If it is, how often?

I do know day traders that manage to make money, precisely because they know a specific market, limit their scope of stocks and manage to stay within their sphere of competence. But even then it still takes a long time to get the hang of it.

I still think day trading is mostly people with a high degree of luck being fooled by randomness, and I haven't seen a study proving it otherwise (with like a bunch of Monte Carlo simulations to show how a specific Trader strategy has worked for thousands of others in similar conditions for example).

I do have one caveat, I've got friends working in High-Frequency Trading(HFT) firms that employ day traders who share their strategies so their algorithms can make trades more efficiently. But HFT is a whole different topic that will need to have its own post.

Meanwhile, you can take a look at further statistics around Day Trading here.

Thankfully even if you do choose value investing, you can still "go with the best" and buy ETFs where you'll have a team of qualified people studying the market for you, even Renaissance Technologies have ETFs available to be invested in.

As always, it pays off well to know where you are getting yourself into and how much you are willing to risk versus getting safe ROIs.

It was a pleasure for me to write about this, and I wish that it was a pleasure for you to read it as well. Thanks for your attention and I'll see you next week.

😗 Enjoy my writing?

Like my content? Feel free to Buy me a Coffee ☕.

Subscribe to my exclusive email newsletter here.

Forward to a friend and let them know where they can subscribe (hint: it’s here).

Anything else? Just say hello in the comments :).

Join an Exclusive Tech Friendly Community! Connect with like-minded people who are interested in tech, design, startups, and growing online — apply here.

Resources

- Barber, Lee, Odean (2010): Do Day Traders Rationally Learn About Their Ability?

- Jim Simons (mathematician) Wikipedia Article (Yeah I used Wikipedia, deal with it)

- More Statistics on Day Trading: https://tradeciety.com/24-statistics-why-most-traders-lose-money

- Graphs generated using TradingView